Crowdfunding: An Alternative to Traditional Private Equity?

Crowdfunding has become a popular alternative to traditional private equity investment for startups and small businesses. With the rise of online platforms like Kickstarter and Indiegogo, entrepreneurs are able to raise funds directly from the public, bypassing traditional investors and bank loans.

In this article, we will explore the advantages and disadvantages of crowdfunding as an alternative to traditional private equity investment, and determine whether it is a viable option for businesses looking to raise capital.

Advantages of Crowdfunding

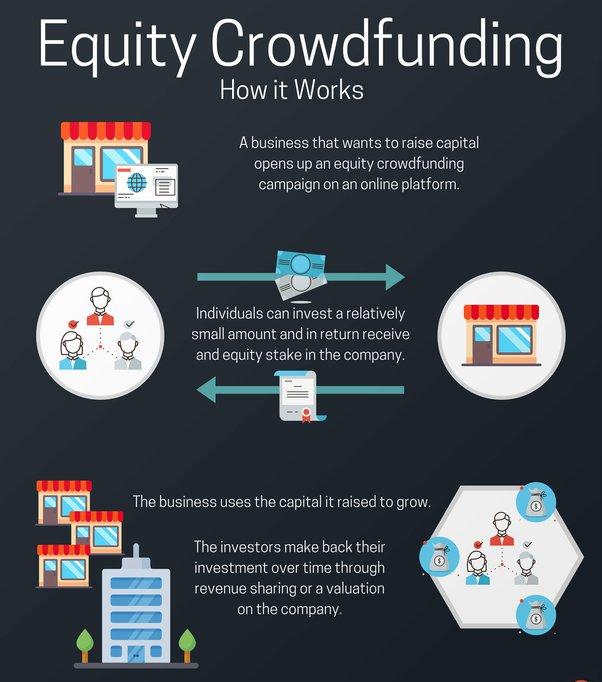

- Direct Access to Investors: Crowdfunding allows businesses to bypass traditional investors and bank loans, and directly access a large pool of investors. This can be a significant advantage for startups and small businesses that may not have the connections or credibility to attract investors through traditional means.

- Flexible Funding Options: Crowdfunding platforms offer a variety of funding options, including equity, debt, and rewards-based funding. This allows businesses to choose the funding option that best suits their needs and goals.

- Transparency: Crowdfunding platforms are required to provide regular updates on the progress of the project, and to disclose any changes to the funding goal or timeline. This transparency can help to build trust and confidence among investors, and can also help to prevent fraud and misrepresentation.

- No Middleman: Traditional private equity investment often involves a middleman, such as a venture capital firm or investment bank. With crowdfunding, businesses can raise funds directly from the public, without the need for a middleman.

Disadvantages of Crowdfunding

- Regulation: Crowdfunding is regulated by the Securities and Exchange Commission (SEC), and businesses must comply with a number of laws and regulations in order to raise funds through crowdfunding. This can be a time-consuming and costly process, and can also limit the amount of funds that a business can raise.

- Limited Funding Options: Crowdfunding platforms offer a limited range of funding options, compared to traditional private equity investment. This can be a disadvantage for businesses that require a specific type of funding, such as a loan or equity investment.

- Limited Investor Pool: Crowdfunding platforms may not have a large pool of investors, compared to traditional private equity investment. This can make it difficult for businesses to raise the funds they need through crowdfunding.

- Limited Liability: Crowdfunding investors may not have the same level of protection as traditional private equity investors. This can be a disadvantage for businesses that require a high level of protection for their investors.

Conclusion

Crowdfunding has become a popular alternative to traditional private equity investment for startups and small businesses. While crowdfunding has its advantages, it also has its disadvantages. Businesses should carefully consider the pros and cons of crowdfunding before deciding whether it is the right option for their business.

In conclusion, crowdfunding is an alternative to traditional private equity investment that offers direct access to investors, flexible funding options, transparency, and no middleman. However, crowdfunding is also regulated by the SEC, has limited funding options, a limited investor pool, and limited liability. Businesses should carefully consider the pros and cons of crowdfunding before deciding whether it is the right option for their business.