Growth vs. Value Stocks: What's the Difference?

Investing in stocks can be a complex and exciting endeavor. There are many different types of stocks to choose from, and it can be difficult to know which one is right for you. Two of the most common types of stocks are growth stocks and value stocks. In this article, we will explore the differences between these two types of stocks and help you decide which one is best for your investment strategy.

What are Growth Stocks?

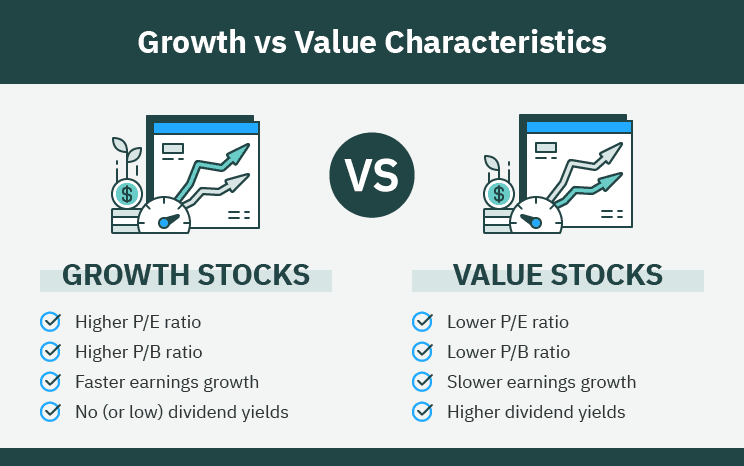

Growth stocks are stocks that are expected to experience significant growth in the future. These stocks are often associated with high-growth industries or companies that have a strong track record of innovation and success. Growth stocks are often characterized by their high price-to-earnings (P/E) ratios and high price-to-sales (P/S) ratios.

Growth stocks are typically considered to be more risky than value stocks, as they are often associated with high levels of uncertainty and volatility. However, they can also offer significant returns for investors who are willing to take on this risk.

What are Value Stocks?

Value stocks, on the other hand, are stocks that are considered to be undervalued by the market. These stocks are often associated with companies that are experiencing financial difficulties or have underperformed the market in the past. Value stocks are often characterized by their low price-to-earnings (P/E) ratios and low price-to-sales (P/S) ratios.

Value stocks are typically considered to be less risky than growth stocks, as they are often associated with lower levels of uncertainty and volatility. However, they can also offer significant returns for investors who are willing to wait for the market to recognize the true value of the company.

How to Choose Between Growth and Value Stocks

Deciding between growth and value stocks can be a difficult decision, as both types of stocks have their own advantages and disadvantages. Here are some factors to consider when choosing between the two:

- Risk Tolerance: If you are a risk-averse investor, value stocks may be a better choice for you. Value stocks are often considered to be less risky than growth stocks, as they are associated with lower levels of uncertainty and volatility.

- Timeframe: If you are looking for short-term gains, growth stocks may be a better choice for you. Growth stocks are often expected to experience significant growth in the future, which can lead to higher returns in the short term.

- Investment Goals: If you are looking to invest for the long term, value stocks may be a better choice for you. Value stocks are often considered to be less risky than growth stocks, which can make them a better choice for investors who are looking to build their portfolio over the long term.

Investing in stocks can be a complex and exciting endeavor, and there are many different types of stocks to choose from. Growth stocks and value stocks are two of the most common types of stocks, and they both have their own advantages and disadvantages. Growth stocks are associated with high levels of uncertainty and volatility, but they can also offer significant returns for investors who are willing to take on this risk. Value stocks, on the other hand, are considered to be less risky than growth stocks, but they can also offer significant returns for investors who are willing to wait for the market to recognize the true value of the company. Ultimately, the decision between growth and value stocks will depend on your risk tolerance, timeframe, and investment goals.