Venture Capital Funding: Selecting the Right Partners for Growth

Introduction

Growth is a natural part of any business, and as your company expands, you may need to consider venture capital funding to help take your business to the next level. However, selecting the right partners for growth can be a complex process, and it's essential to choose carefully to ensure that your investment is well-placed and aligned with your company's goals. In this article, we will explore the process of selecting the right venture capital partners for growth and provide some tips for making the most informed decision.

What is Venture Capital Funding?

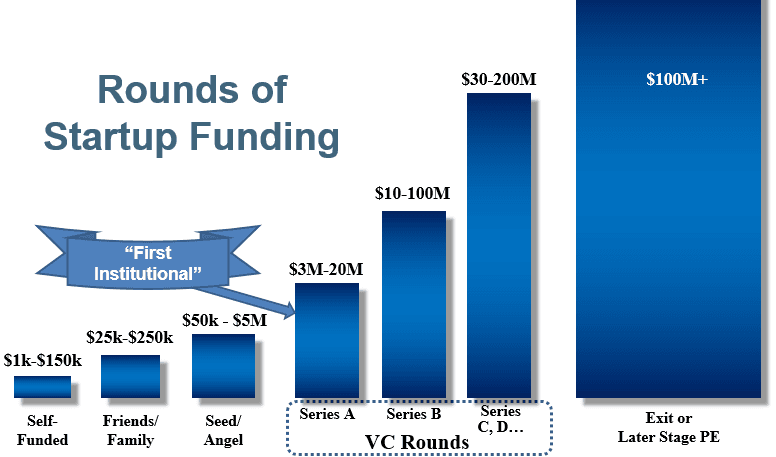

Venture capital funding is a type of investment that is typically provided to early-stage companies by investors who are looking to make a profit by investing in companies that they believe have the potential to grow and become successful. Venture capital firms typically invest in companies that are in the early stages of development, and they provide funding in exchange for a stake in the company.

The Benefits of Venture Capital Funding

There are several benefits to seeking venture capital funding for your business. One of the most significant benefits is the potential for rapid growth. Venture capital firms often have access to large amounts of capital, which can be used to fund the growth of your business. This can help you to expand your operations, increase your market share, and ultimately increase your profitability.

Another benefit of venture capital funding is the access to expertise. Venture capital firms typically have a team of experienced professionals who can provide guidance and support to help your business grow. This can include everything from strategic advice to hands-on support in areas such as marketing, sales, and finance.

The Risks of Venture Capital Funding

While venture capital funding can offer significant benefits, it's important to be aware of the risks as well. One of the biggest risks is the potential for loss of control. Venture capital firms typically have a say in how the company is run, and they may have input into key decisions such as hiring, marketing, and product development. This can be a concern for some business owners who want to retain control over their company.

Another risk is the potential for a mismatch between the goals of the venture capital firm and the goals of the business. Venture capital firms typically have a specific investment strategy, and they may not be interested in investing in companies that don't align with their goals. This can be a concern for business owners who want to pursue a specific strategy or market.

How to Select the Right Venture Capital Partners for Growth

Selecting the right venture capital partners for growth can be a complex process, but there are some steps that you can take to help ensure that you choose the best partners for your business. One of the first steps is to conduct thorough research on the venture capital firms that are available in your industry. Look at their track record, the types of companies they typically invest in, and the level of expertise that they can offer.

Another important step is to have a clear understanding of your own goals and objectives. What are you looking to achieve with the venture capital funding? Are you looking to expand your operations, increase your market share, or develop a new product? Having a clear understanding of your goals can help you to select venture capital partners who are aligned with your strategy.

It's also important to have a clear understanding of the terms of the investment. What are the terms of the investment, such as the amount of funding, the valuation, and the terms of the investment? It's important to understand these terms so that you can make an informed decision about the investment.

Conclusion

Selecting the right venture capital partners for growth can be a complex process, but it's essential to choose carefully to ensure that your investment is well-placed and aligned with your company's goals. By conducting thorough research, understanding your own goals and objectives, and having a clear understanding of the terms of the investment, you can make an informed decision about the venture capital partners that are best suited for your business.