Credit Card Debt: Tips for Paying Down Your Balances

Credit card debt can be a daunting and overwhelming problem, but with the right strategies and tips, you can start to pay down your balances and regain financial stability. In this article, we will explore some effective ways to tackle credit card debt and get your finances back on track.

Understanding Your Credit Card Debt

The first step in tackling credit card debt is to understand the extent of your debt and the interest rates you are paying. Take a close look at your credit card statements and make a list of all your credit card balances, including the minimum payments due each month. You should also note the interest rates on each card, as these can vary widely.

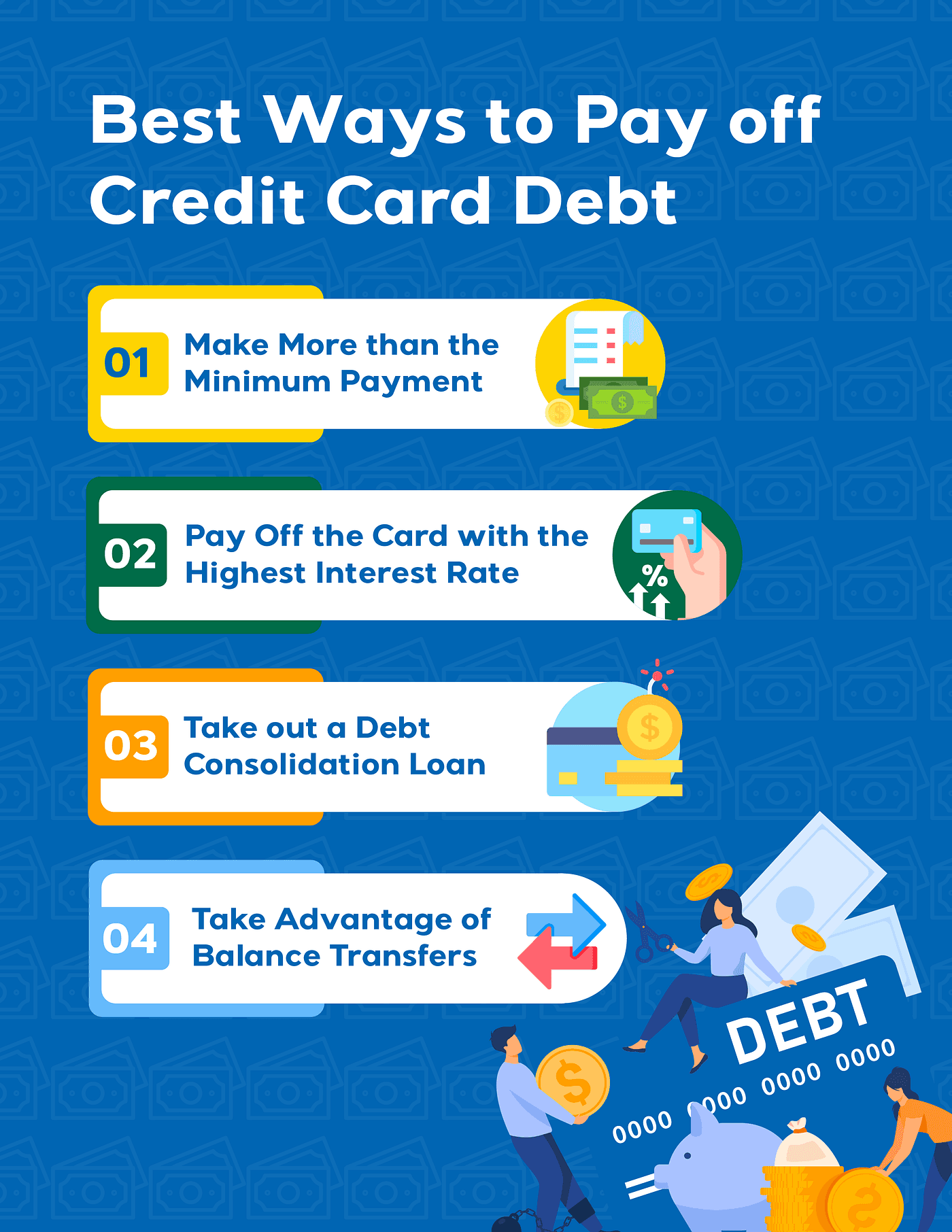

Once you have a clear understanding of your credit card debt, you can start to develop a plan for paying it down. The most important thing to remember is to prioritize your payments and focus on the card with the highest interest rate. This will help you to save the most money in interest payments over time.

Paying Down Your Credit Card Debt

There are a few strategies you can use to pay down your credit card debt. The first is to pay off the card with the highest interest rate first. This will help you to save the most money in interest payments over time. The second is to pay off the card with the lowest balance first. This will help you to build momentum and motivation as you work towards paying off your debt.

Another effective strategy is to pay off your credit card debt in full each month. This will help you to avoid paying interest on your balances and will give you a sense of accomplishment as you work towards financial freedom. You can also consider using a credit card balance transfer to move your debt to a card with a lower interest rate.

Finally, it's important to remember that paying down your credit card debt is a long-term process. It may take months or even years to pay off your debt, but with a plan and a commitment to making regular payments, you can achieve financial freedom.

Conclusion

Credit card debt can be a difficult and overwhelming problem, but with the right strategies and tips, you can start to pay down your balances and regain financial stability. By understanding your credit card debt, prioritizing your payments, and focusing on the card with the highest interest rate, you can start to make progress towards paying off your debt. Remember that paying down your credit card debt is a long-term process, but with a plan and a commitment to making regular payments, you can achieve financial freedom.