The Role of Disability Insurance in Your Financial Plan

Disability insurance is a critical component of any comprehensive financial plan. It provides financial protection in the event of a disabling illness or injury, ensuring that you and your loved ones can continue to live comfortably and maintain their standard of living. In this article, we will explore the role of disability insurance in your financial plan and the benefits it can offer.

The Basics of Disability Insurance

Disability insurance is a type of insurance that provides financial assistance to individuals who are unable to work due to a disabling illness or injury. It can help cover expenses such as lost wages, medical bills, and living expenses. There are two main types of disability insurance: short-term and long-term.

Short-term disability insurance (STDI) provides temporary financial assistance for a limited period of time, typically up to 12 months. This type of insurance is often offered by employers as a benefit to their employees. STDI can help cover expenses such as lost wages and medical bills while the individual is unable to work due to a disabling illness or injury.

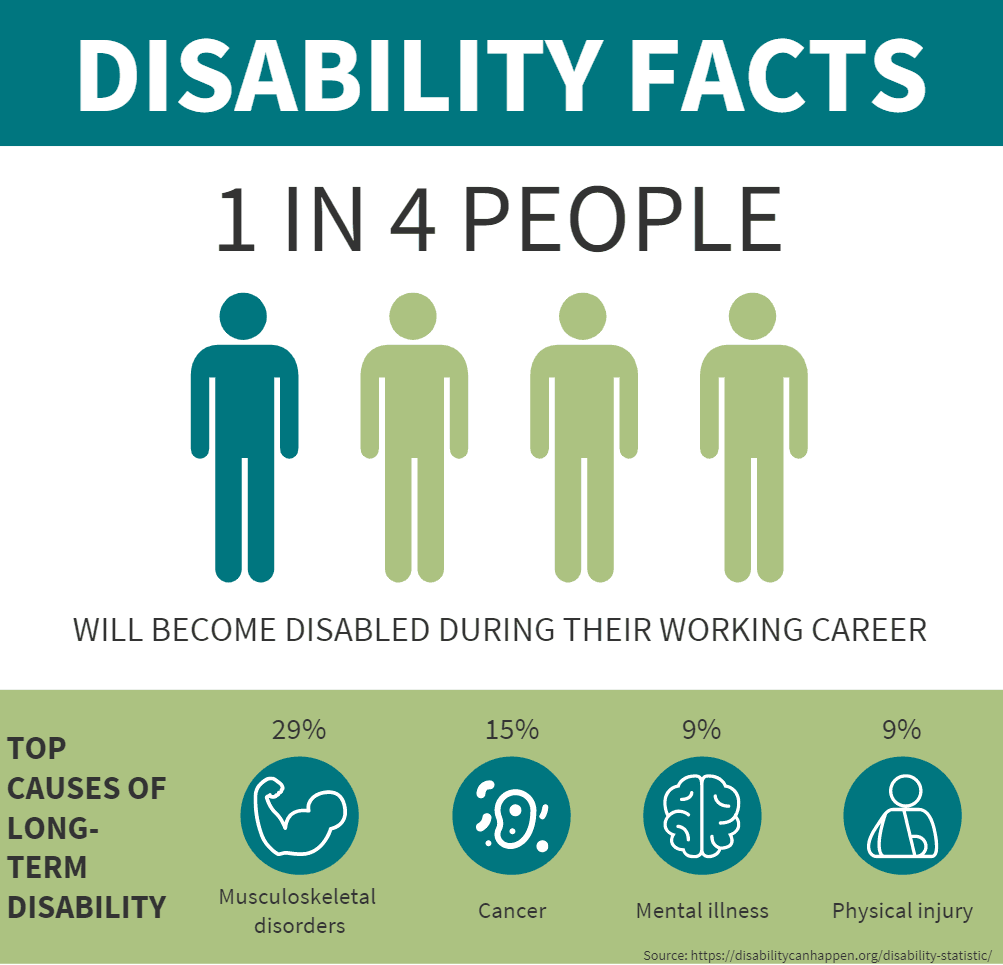

Long-term disability insurance (LTDI) provides financial assistance for a longer period of time, typically up to 26 weeks or more. This type of insurance is often purchased on an individual basis and can be used to cover expenses such as lost wages, medical bills, and living expenses.

The Benefits of Disability Insurance

Disability insurance can provide a range of benefits to individuals and their families. Here are some of the most important benefits:

- Financial protection: Disability insurance can provide financial protection in the event of a disabling illness or injury. This can help ensure that individuals and their families can continue to live comfortably and maintain their standard of living.

- Lost wages: Disability insurance can help cover lost wages while the individual is unable to work due to a disabling illness or injury. This can help ensure that individuals and their families can continue to receive a steady income.

- Medical bills: Disability insurance can help cover medical bills while the individual is unable to work due to a disabling illness or injury. This can help ensure that individuals and their families can receive the medical care they need.

- Living expenses: Disability insurance can help cover living expenses while the individual is unable to work due to a disabling illness or injury. This can help ensure that individuals and their families can continue to live comfortably.

How to Choose the Right Disability Insurance Policy

Choosing the right disability insurance policy can be a complex process. Here are some tips to help you make an informed decision:

- Determine your needs: The first step in choosing the right disability insurance policy is to determine your needs. What expenses do you need to cover while you are unable to work due to a disabling illness or injury?

- Consider your income: Your income will play a significant role in determining the amount of disability insurance you need. The higher your income, the more disability insurance you will need.

- Compare policies: There are many different disability insurance policies available on the market. Compare policies to find the one that best meets your needs and budget.

- Consider your age: Your age will also play a role in determining the amount of disability insurance you need. The older you are, the more disability insurance you will need.

Disability insurance is a critical component of any comprehensive financial plan. It provides financial protection in the event of a disabling illness or injury, ensuring that you and your loved ones can continue to live comfortably and maintain their standard of living. Whether you are an individual or a business owner, it is important to have disability insurance in place to protect your financial future. By choosing the right disability insurance policy and considering your needs, you can ensure that you and your family are financially protected in the event of a disabling illness or injury.

disability insurance policyfinancial protection for disabilitydisabling illness or injuryunable to workfinancial assistancecritical component of financial plandisability insurance benefitsdisability insurance for individualsdisability insurance for familiesdisability insurance for business ownersshort-term disability insurance benefitslong-term disability insurance benefitsshort-term disability insurance policylong-term disability insurance policydisability insurance policy comparisondisability insurance policy selection